Real Estate Housing Market 2023: What to Expect

The real estate housing market is constantly changing, and it can be difficult to keep up with the latest trends. However, by understanding the factors that are driving the market, you can make informed decisions about your own real estate investments.

In 2023, the real estate housing market is expected to continue to be strong. This is primarily due to the following factors:

- A strong job market in many areas

- A limited supply of homes

- Buyer demand is high

These factors are both contributing to rising home prices and increased demand for housing. As a result, buyers are facing more competition and may need to be prepared to pay more for a home.

However, there are some signs that the market may be starting to cool off in some parts of the country. For example, home sales have been declining in some areas, and inventory levels are starting to rise. This suggests that the market may be reaching a peak, and that prices may start to stabilize or even decline in the coming months. However, this may not be signs of a housing crash as we saw in 2008 and here’s why.

Why Today’s Housing Market Is Not About To Crash

There’s been some concern lately that the housing market is headed for a crash. And given some of the affordability challenges in the housing market, along with a lot of recession talk in the media, it’s easy enough to understand why that worry has come up.

But the data clearly shows today’s market is very different than it was before the housing crash in 2008. Rest assured, this isn’t a repeat of what happened back then. Here’s why.

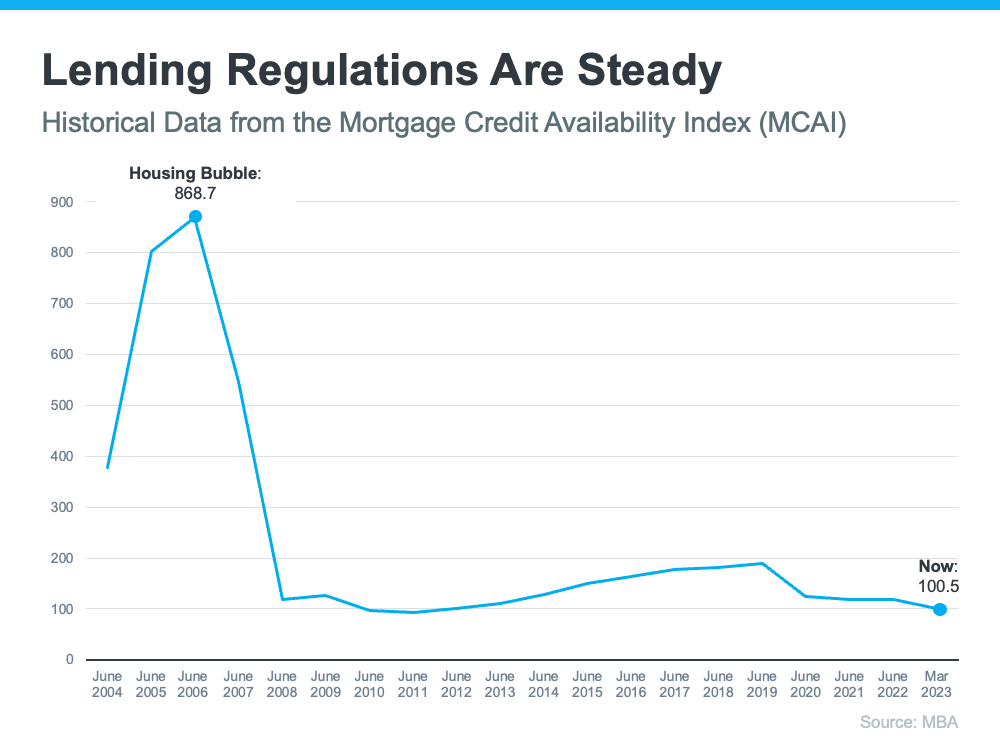

It’s Harder To Get a Loan Now

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one. As a result, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices.

Things are different today as purchasers face increasingly higher standards from mortgage companies. The graph below uses data from the Mortgage Bankers Association (MBA) to show this difference. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is.

Unemployment Recovered Faster This Time

Unemployment Recovered Faster This Time

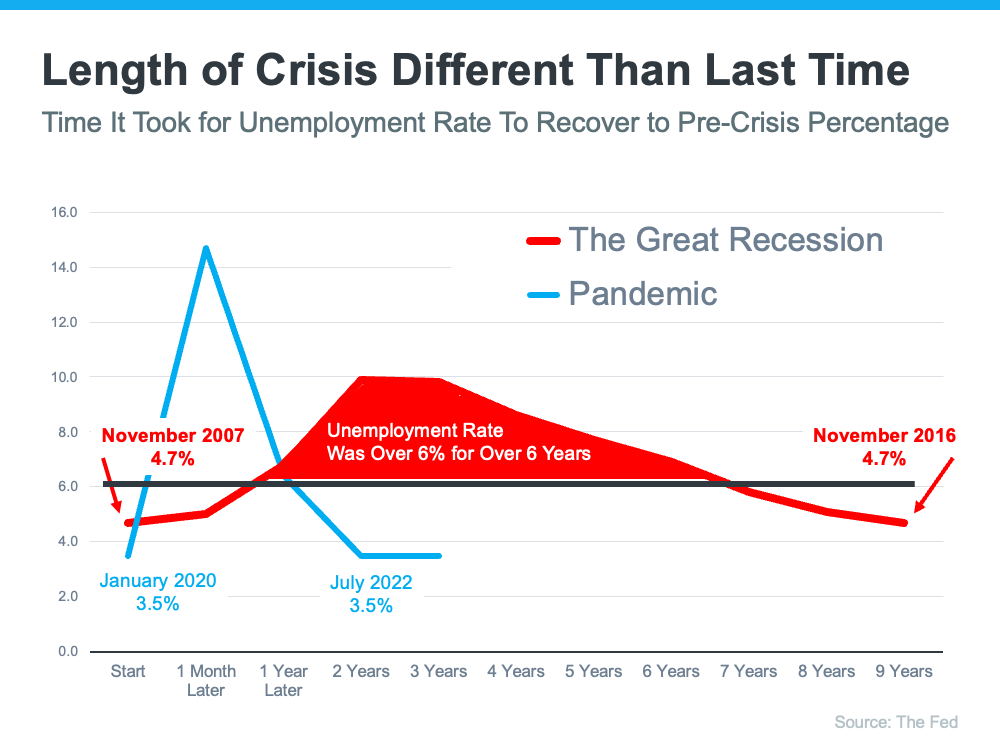

While the pandemic caused unemployment to spike over the last couple of years, the jobless rate has already recovered back to pre-pandemic levels (see the blue line in the graph below). Things were different during the Great Recession as a large number of people stayed unemployed for a much longer period of time (see the red in the graph below):

Here’s how the quick job recovery this time helps the housing market. Because so many people are employed today, there’s less risk of homeowners facing hardship and defaulting on their loans. This helps put today’s housing market on stronger footing and reduces the risk of more foreclosures coming onto the market.

There Are Far Fewer Homes for Sale Today

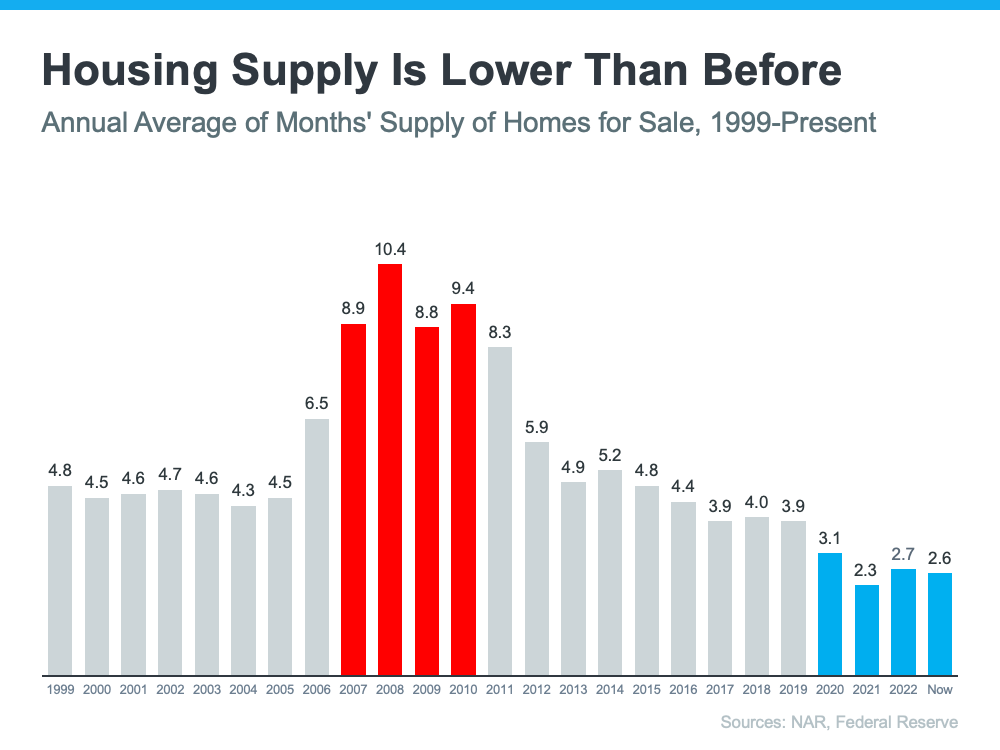

There were also too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Today, there’s a shortage of inventory available overall, primarily due to years of underbuilding homes.

The graph below uses data from the National Association of Realtors (NAR) and the Federal Reserve to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 2.6-months’ supply. There just isn’t enough inventory on the market for home prices to come crashing down like they did in 2008.

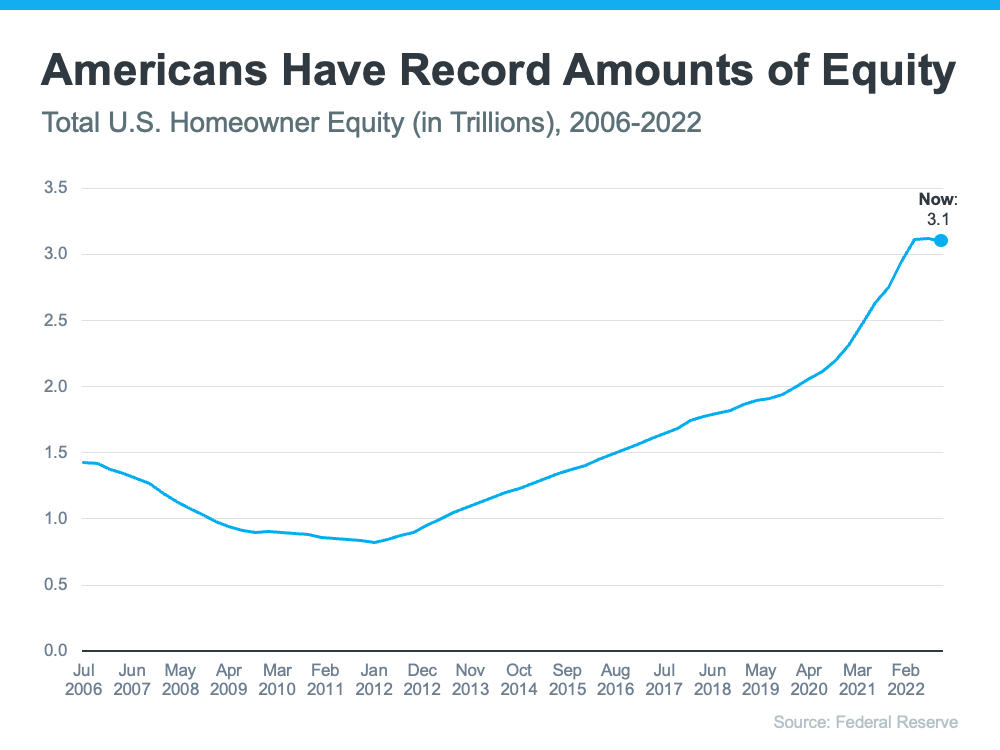

Equity Levels Are Near Record Highs

That low inventory of homes for sale helped keep upward pressure on home prices over the course of the pandemic. As a result, homeowners today have near-record amounts of equity (see graph below):

And, that equity puts them in a much stronger position compared to the Great Recession. Molly Boesel, Principal Economist at CoreLogic, explains:

“Most homeowners are well positioned to weather a shallow recession. More than a decade of home price increases has given homeowners record amounts of equity, which protects them from foreclosure should they fall behind on their mortgage payments.”

The graphs above should ease any fears you may have that today’s housing market is headed for a crash. The most current data clearly shows that today’s market is nothing like it was last time.

Bottom Line

Overall, the real estate housing market in 2023 is expected to be strong, with signs that it may be starting to cool off in some areas. Overall buyers should be prepared to face more competition and higher prices, but there are still opportunities to find a good deal on a home.

Here are some tips for buyers in the 2023 real estate housing market:

- Be prepared to act quickly by being pre-approved for a mortgage. Homes are selling quickly in many areas, so buyers need to be prepared to make an offer as soon as possible.

- Be prepared to pay more. Home prices are rising in many areas, so buyers need to be prepared to pay more than they would have in the past.

- Be flexible with your location. If you’re not willing to move to a less desirable area, you may have a harder time finding a home.

- Be prepared to compromise. Buyers may need to compromise on things like the size of the home or the location in order to find a home that they can afford.

The real estate housing market in 2023 is expected to be a challenging one for buyers. However, by understanding the factors that are driving the market and by being prepared to act quickly, buyers can still find a home.

Let’s connect if you’re looking to buy or sell a home anywhere in the Riverside or Inland Empire areas of Southern California.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link